Important update: whiplash reforms set to become law

Controversial legislation to reduce whiplash insurance claims has now passed successfully through the House of Commons - to the dismay of personal injury lawyers concerned about how it will affect access to justice for ordinary people.

The third reading of the Civil Liability Bill was approved by 56 votes with the government successfully defeating Labour party amendments aimed at reducing its impact.

Brett Dixon, president of the not-for-profit Association of Personal Injury Lawyers (APIL) representing 3,400 members, said: "Contrary to what ministers claim, the government has made it clear that it doesn't care about injured people, no matter how devastating the injuries. Insurance companies' profit margins are obviously more important."

The next stage of the Bill's journey will see its details considered for amendment before it moves forward to royal assent. It is expected to become law in April 2020.

What are the changes?

The so-called "whiplash" reforms will introduce an increase in the small claims limit from £1,000 to £5,000 for injuries arising from a road traffic accident (RTA) and are being brought in because the government believes many claims currently are 'minor, exaggerated or fraudulent' and are leading to an increase in car insurance premiums for innocent motorists.

This change means many claimants will not be able to:

• Afford legal representation to pursue their claim directly against the defendant's motor insurance company and will have to represent themselves (as a high number of RTA claims will fall within the £5,000 small claims limit);

• Achieve fair settlement of their claims, or recover legal costs, with a high risk of under settlement.

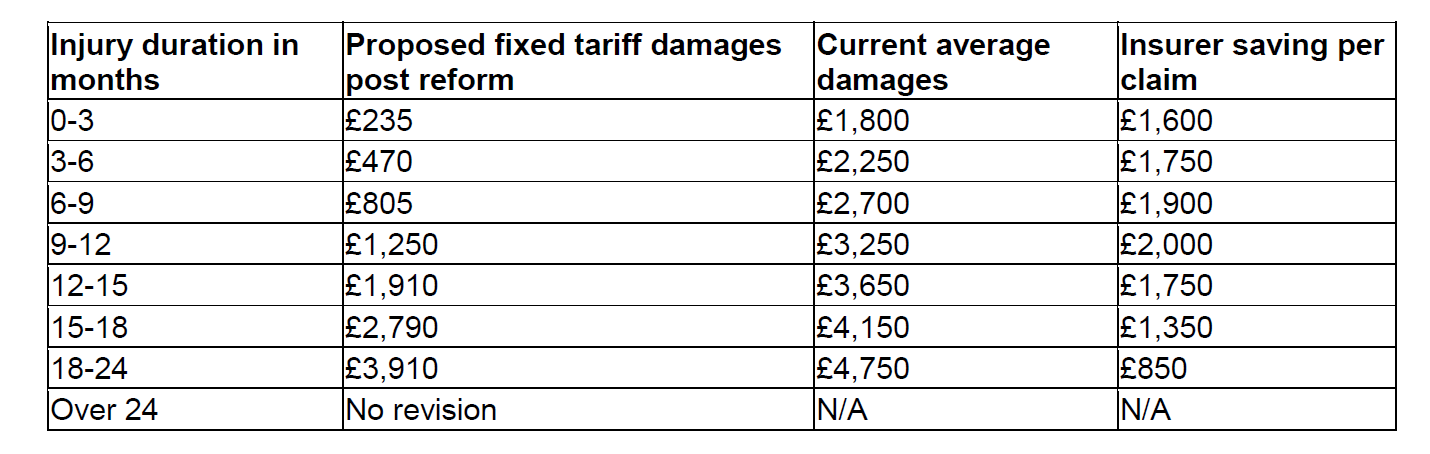

In addition, a scheme of fixed tariffs limiting compensation to what many see as shockingly low levels, has been set.

For example, the figure of £235 compensation for an injury lasting up to three months is equivalent, one Labour MP pointed out, to some payouts for a flight delay.

The table below outlines the tariffs.

Growing concerns

The Association of Personal Injury Lawyers (APIL), of which myself and all Wards Solicitors' personal injury lawyers are members, believe that the government has 'discarded the principle of full and fair redress for people injured through no fault of their own' by pushing through the bill.

APIL president Mr Dixon added: "100 per cent redress is the cornerstone of the justice system for people who fall victim to negligence. The government has paid lip service to the principle of full compensation throughout this debate but has consistently failed to deliver. It does not care about the repercussions for real people, or it would have listened to the evidence.

"It has been utterly determined to make these reforms happen since being seduced by insurance industry rhetoric. Genuine injured people at either end of the scale have been vilified for the sake of saving a supposed £35 on each premium."

Do the numbers add up?

Rather than backing up government claims that the number of whiplash injuries is inflating insurance premiums, figures from the Association of British Insurers actually show that small bodily injury claims, including whiplash, account for just ten per cent of the cost of motor insurance. In comparison, repair costs to a vehicle, have increased by £668 million since 2013 and account for a significant 30 per cent.

With 1.2 million adults in England injured in a road traffic accident in the last three years alone, the problem is certainly not one that is going to go away.

Wards Solicitors' Angela Carnell has more than 20 years' experience of representing claimants injured as a result of road accidents. For help on this area of the law, please contact her or any member of the Accident and Injury team.