Debt Collection Process

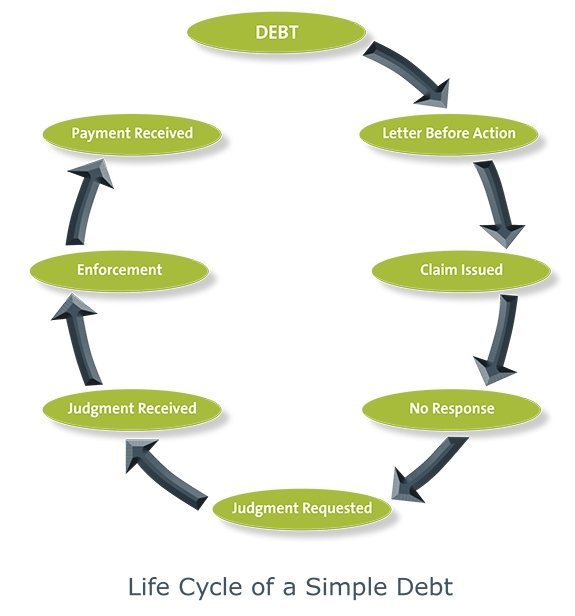

To help you to understand the steps required in recovering your debt, we have set out an outline of the debt collection process below.

To help you to understand the steps required in recovering your debt, we have set out an outline of the debt collection process below.

"Its been refreshing to deal with somebody as professional and efficient as yourself, especially your prompt communication throughout. These seem to be rare attributes these days."

"James dealt with matters very efficiently and empathetically and always answered telephone calls and queries the same day - excellent communication from him."

A sole-trader is a self-employed person, who has full control and ownership of the business in question.

A partnership is made up of two or more people and a Partnership Agreement is usually drawn up to regulate the relationship between partners. This type of business is not registered with Companies House.

A limited company will be registered at Companies House and will have directors, shares and shareholders.

If you are not acting as a sole-trader, a partnership or a company, it is likely that you are an individual.

Section 69 of the County Courts Act 1984 provides that you may claim statutory interest when making a claim in the County Court. Interest will be awarded at the court’s discretion and at such rate and for such a period as the court thinks fit.

The general rule is that a County Court Judgement will also carry interest at 8% from the date of judgement.

We will calculate this for you and make sure it is added to the amount you are owed, if your matter reaches the stage of court proceedings.

This Act imposes interest on late payments of debts in relation to business-to-business contracts for the supply of goods or services.

Interest is calculated by adding 8% to the Bank of England Base Rate, which is fixed every 6 months.

You will not be able to claim this type and rate of interest however if the contract in question already sets a rate.

A letter before action is a concise letter which is sent to the debtor, setting out the matter and requesting payment within a certain time period. The time limit for a response from the debtor must be reasonable and a minimum of 7 days is standard.

This letter is a requirement in the debt collection process as it is part of the Court’s Practice Direction relating to the parties’ conduct prior to starting court proceedings.

The court will expect parties to have complied with this Practice Direction and may impose cost sanctions and other penalties for a party’s failure to do so.

We can draft and send this letter to your debtor for a fixed fee of £50.00 plus Vat.

If the debtor fails to respond to the letter before action within the time limit provided, it may then be necessary to start court proceedings.

Before court proceedings are instigated, however, we must be satisfied that the debtor has sufficient funds or assets to be able to settle any Judgment that is obtained by you.

If you are not aware of your debtor’s financial circumstances, it is possible to take steps to investigate this. This may include, for example, obtaining title entries from the Land Registry with regard to any property you believe your debtor owns or instructing a private investigator to seek out information on your debtor.

However, if you choose to instruct us to issue proceedings without knowledge of your debtor’s financial position, you should be aware that it is possible your debtor may not be able to satisfy any judgment you obtain.

Once you provide us with instructions to proceed, we will draft a Claim Form on your behalf. This will be sent to you for your approval and signature and will thereafter be sent to the court with the relevant fee.

The court will then issue the claim and serve the Claim Form on the Defendant, who will have 14 days to file an Acknowledgment of Service or Defence. If an Acknowledgement of Service is filed, the Defendant will have 28 days from service of the Claim Form to file a Defence.

If the Defendant files a Defence with the court, your matter will be passed over to our Litigation Department, who will be able to provide you with specific advice as to the way to progress your matter in this regard.

Alternatively, if the Defendant does not respond to your claim within the time limit, we can immediately apply to the court for Judgment in Default. This means that the court will order Judgment without the need for a trial.

Once Judgment is granted by the court, it will be registered (having an effect on the credit record of the individual/company in question) if payment is not forthcoming within 28 days.

However, if it becomes apparent that the Defendant is still unwilling to make payment, you may need to instruct us to take further steps to enforce the Judgment. You may provide instructions for us to take this step immediately on receipt of Judgment.

There are various methods of enforcement and the most relevant method will depend on the circumstances of the case.

Before a decision is made in relation to this, it may be necessary to carry out further investigations in relation to the Defendant’s assets. This will help us to decide which type of enforcement action is likely to be the most successful.

The various types of enforcement methods are set out below:-

A Warrant of Execution is issued in the County Court. It is executed by a court bailiff, who will attend the Defendant’s premises and seek payment or seize goods to the value of the Judgment.

A court fee is payable, however the court will add this to the amount owed and we can then seek to recover this from the Defendant.

A Writ is issued in the High Court and entitles an Enforcement Officer to pursue the debtor for settlement of the judgment debt. This may be obtained by way of the seizure and thereafter sale of the debtor’s goods.

The Enforcement Officer will initially seek to recover any costs incurred by him from the debtor directly.

In most cases for debts over £600, we can take this action. Where the debt is over £5,000 it must be transferred to the High Court for enforcement.

A successful application for a Charging Order will result in a charge (similar to a mortgage) being placed on the Defendant’s property. This means that the judgment debt is secured against the property in question.

If the Defendant sells or remortgages the property, he will be bound to pay you what is owed from the proceeds, provided there is enough equity in the property to satisfy the judgment.

If he does not sell or remortgage the property, an Order for Sale may be applied for, forcing the Defendant to sell the property and pay what is owed with the balance of the sale proceeds.

However, the court will use its discretion in relation to whether to grant such an order and various factors are taken into consideration in this regard.

An Attachment of Earnings Order will be relevant if the debtor is an individual and you have current details of his/her employment.

If this type of order is granted by the County Court, it will compel the debtor’s employer to deduct a proportion of his/her earnings to pay to you until the judgment debt is satisfied.

If this type of order is granted, sums that are in the hands of a third party, such as a bank, will be earmarked in order to settle the judgment debt.

In some circumstances, another option may be to make the Defendant bankrupt where the debtor is an individual or wind it up if it is a company. Usually, a Statutory Demand would be served first and proceedings would thereafter be started to either make the individual bankrupt or wind up the company.

For further information contact our business disputes team.

Search site

Contact our offices

Make an enquiry

Important notice: please read

Cyber-crime is on the increase and solicitor transactions can be hijacked by scammers. This commonly takes the form of email or phone interception.

Please be aware that we will never ask you to send money to a different bank account, particularly by email. If you receive a request for money from us, we advise that you call (using the number on our website) to verify our bank details before sending funds.

If you receive an email giving any other bank account please telephone us immediately without replying to the email or sending any money. We accept no responsibility if you transfer money to a bank account which is not ours.

Wards Solicitors